Journal Entry To Record Sales

A sales journal entry is a journal entry in the sales journal to record a credit sale of inventory. All of the cash sales of inventory are recorded in the cash receipts periodical and all non-inventory sales are recorded in the general journal.

Since a sales journal entry consists of selling inventory on credit, four main accounts are affected by the business transaction: the accounts receivable and acquirement accounts as well as the inventory and cost of goods sold accounts.

When a piece of merchandise or inventory is sold on credit, two business transactions need to exist record. First, the accounts receivable account must increment by the amount of the sale and the acquirement account must increase by the same corporeality. This entry records the corporeality of money the customer owes the visitor besides as the revenue from the sale.

Second, the inventory has to be removed from the inventory account and the cost of the inventory needs to exist recorded. So a typical sales journal entry debits the accounts receivable business relationship for the sale price and credits revenue business relationship for the sales price. Toll of goods sold is debited for the cost the company paid for the inventory and the inventory account is credited for the same cost.

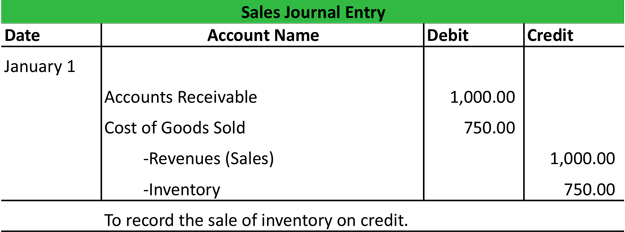

Sales Journal Entry Example

Trivial Electrodes, Inc. is a retailer that sells electronics and calculator parts. On Jan 1, Little Electrode, Inc. sells a computer monitor to a client for $1,000. Little Electrode, Inc. purchased this monitor from the manufacturer for $750 three months agone. Here'due south how Little Electrode, Inc. would record this sales journal entry.

Journal Entry To Record Sales,

Source: https://www.myaccountingcourse.com/online-accounting-course/sales-journal-entry

Posted by: overturffrect1967.blogspot.com

0 Response to "Journal Entry To Record Sales"

Post a Comment